Common Misconceptions About Offshore Trusts—Debunked

Common Misconceptions About Offshore Trusts—Debunked

Blog Article

Understanding the Perks and Obstacles of Establishing an Offshore Trust Fund for Property Protection

When considering possession security, developing an overseas depend on could appear appealing. It provides privacy, prospective tax obligation advantages, and a means to protect your assets from creditors. However, the complexities and costs involved can be daunting. You'll need to navigate legal factors to consider and conformity problems that differ across jurisdictions. Are you prepared to weigh these benefits against the challenges? The next steps could greatly affect your economic future.

What Is an Offshore Depend On?

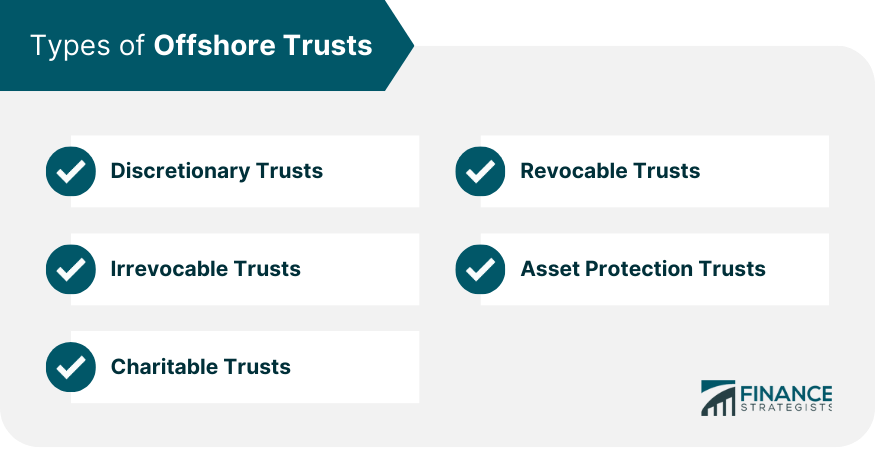

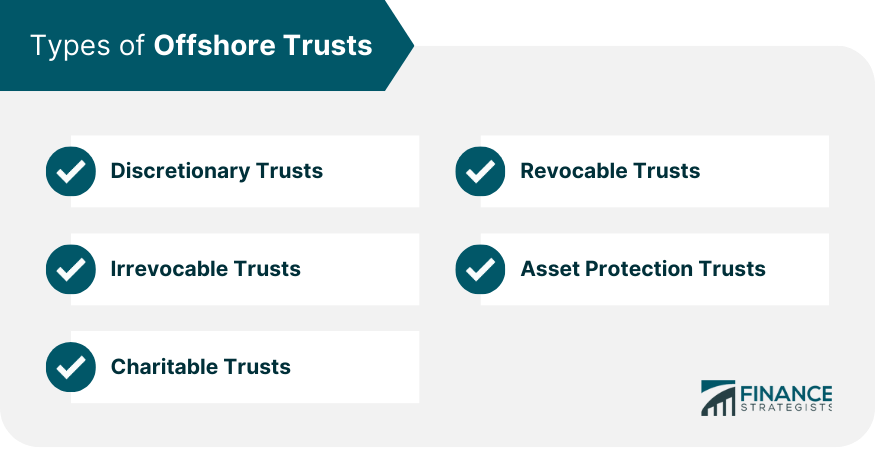

An offshore trust fund is a legal arrangement where you transfer your properties to a depend on that's developed outside your home nation. This configuration enables you to take care of and shield your wealth in a territory with beneficial laws. You can assign a trustee, that will certainly oversee the trust fund according to your desires. By doing this, you're not just guarding your possessions but likewise possibly gaining from privacy and tax obligation benefits fundamental in some offshore territories.

Secret Benefits of Offshore Depends On for Asset Defense

When thinking about offshore counts on for asset security, you'll discover a number of essential benefits that can greatly influence your monetary security. These trusts provide improved personal privacy, tax advantages, and a legal guard from creditors. Comprehending these advantages can help you make informed decisions regarding your properties.

Enhanced Personal Privacy Security

Several people look for overseas trust funds not simply for monetary advantages, however additionally for improved privacy protection. By establishing an overseas trust, you can separate your personal properties from your public identification, which can hinder unwanted focus and prospective legal cases. Most offshore territories use strong discretion regulations, making it tough for others to access your count on info. This added layer of personal privacy safeguards your economic events from prying eyes, whether it's creditors, litigants, or also intrusive next-door neighbors. Furthermore, you can keep higher control over just how your properties are taken care of and distributed without revealing sensitive information to the general public. Ultimately, an offshore depend on can be an effective tool for shielding your personal privacy while safeguarding your wealth.

Tax Obligation Advantages and Motivations

Beyond enhanced privacy defense, offshore depends on additionally offer considerable tax obligation advantages and rewards that can furthermore boost your financial method. By developing an offshore count on, you might appreciate reduced tax obligation responsibilities depending on the jurisdiction you select. Lots of nations provide beneficial tax obligation prices or exceptions for counts on, enabling your properties to expand without the burden of excessive taxation.

Legal Shield From Creditors

Developing an overseas trust offers you a powerful legal guard against creditors, guaranteeing your properties remain shielded in the face of economic challenges. By positioning your properties in an overseas depend on, you produce an obstacle that makes it difficult for financial institutions to access them. In addition, offshore depends on frequently operate under various lawful jurisdictions, which can supply more advantages in possession security.

Lawful Factors To Consider When Establishing an Offshore Trust Fund

When you're establishing an overseas depend on, comprehending the legal landscape is important. You'll need to carefully select the appropriate territory and guarantee conformity with tax guidelines to shield your possessions properly. Ignoring these aspects can lead to pricey mistakes down the line.

Jurisdiction Selection Standards

Picking the ideal jurisdiction for your overseas depend on is necessary, as it can substantially affect the performance of your possession protection strategy. The convenience of count on facility and ongoing management likewise matters; some jurisdictions use structured procedures. Furthermore, assess any kind of personal privacy laws that guard your information, as privacy is commonly an essential incentive for selecting an offshore depend on.

Conformity With Tax Rules

Understanding conformity with tax laws is essential for the success of your overseas trust fund. Falling short to report your overseas count on can lead to severe penalties, including significant penalties and potential criminal costs. Consulting a tax professional that specializes in overseas counts on can assist you browse these intricacies.

Potential Tax Obligation Advantages of Offshore Depends On

While lots of people consider official statement offshore trusts mainly for possession security, they can likewise use significant tax obligation advantages. By putting your possessions in an offshore trust, you may take advantage of much more favorable tax therapy than you 'd get in your home nation. Lots of jurisdictions have low or no tax prices on income generated by properties kept in these depends on, which can cause substantial cost savings.

In addition, if you're a non-resident recipient, you might stay clear of specific regional tax obligations completely. This can be particularly beneficial for those seeking to protect wealth across generations. Overseas trust funds can offer flexibility in distributing revenue, potentially permitting you to time distributions for tax obligation performance.

Nevertheless, it's important to seek advice from a tax obligation professional familiar with both your home nation's regulations and the overseas jurisdiction's regulations. Capitalizing on these potential tax advantages calls for careful preparation and conformity to assure you remain within lawful borders.

Challenges and Threats Related To Offshore Trust Funds

Although overseas trusts can use various advantages, they also include a selection of obstacles and dangers that you must meticulously take into consideration. One substantial challenge is the complexity of establishing and maintaining the trust. You'll need to navigate various legal and regulatory requirements, which can be time-consuming and might require professional support.

Furthermore, expenses can intensify rapidly, from lawful costs to ongoing management expenditures. It's additionally important to acknowledge that offshore counts on can bring Check Out Your URL in scrutiny from tax obligation authorities. Otherwise structured correctly, you could face penalties or raised tax responsibilities.

Moreover, the capacity for changes in regulations or political environments in the jurisdiction you have actually chosen can pose threats. These changes can influence your depend on's efficiency and your accessibility to properties. Eventually, while offshore trusts can be useful, comprehending these challenges is vital for making notified choices concerning your asset protection technique.

Selecting the Right Jurisdiction for Your Offshore Trust Fund

Just how do you pick the best territory for your offshore trust fund? Begin by taking into consideration the legal framework and property protection regulations of possible jurisdictions. Seek areas recognized for solid privacy securities, like the Cook Islands or Nevis. You'll also wish to examine the territory's reputation; some are a lot more recognized than others in the financial world.

Next, think about tax implications. Some jurisdictions provide tax obligation benefits, while others could not be as beneficial. Offshore Trusts. Access is one more factor-- pick a place where you can easily connect with trustees and lawful experts

Finally, consider the political and economic stability of the territory. A stable environment warranties your properties are less most likely to be influenced by unforeseen modifications. By meticulously weighing these elements, you'll be better geared up to select the right jurisdiction that lines up with your property security goals.

Actions to Developing an Offshore Trust Fund Effectively

Establishing an overseas count on successfully requires careful planning and a series of strategic steps. You need to select the appropriate jurisdiction based on your property security objectives and lawful site link demands. Research study the tax obligation ramifications and personal privacy laws in possible areas.

Next, choose a trusted trustee that recognizes the subtleties of overseas counts on. This individual or institution will take care of the trust fund and warranty conformity with regional guidelines.

Once you have actually chosen a trustee, draft a complete depend on deed describing your intentions and the recipients entailed. It's smart to seek advice from with legal and monetary experts throughout this process to confirm everything aligns with your goals.

After wrapping up the documents, fund the count on by transferring assets. Maintain interaction open with your trustee and evaluate the depend on occasionally to adapt to any adjustments in your scenario or suitable legislations. Complying with these steps faithfully will assist you develop your overseas trust effectively.

Frequently Asked Inquiries

How Much Does It Expense to Establish an Offshore Depend On?

Establishing an overseas trust fund usually costs in between $5,000 and $20,000. Aspects like complexity, territory, and specialist costs influence the total cost. You'll wish to budget plan for ongoing upkeep and lawful expenses also.

Can I Be Both the Trustee and Beneficiary?

Yes, you can be both the trustee and recipient of an overseas count on, yet it's necessary to comprehend the lawful implications. It may complicate property protection, so think about speaking with a specialist for assistance.

Are Offshore Trusts Legal for US People?

Yes, overseas counts on are legal for united state people. Nevertheless, you need to follow tax coverage demands and guarantee the trust straightens with united state legislations. Consulting a lawful specialist is important to navigate the complexities included.

What Occurs if My Offshore Depend On Is Challenged?

If your overseas depend on is challenged, a court might inspect its authenticity, potentially resulting in possession recovery. You'll need to supply proof supporting its credibility and objective to resist any cases successfully.

Just how Do I Pick a Trustee for My Offshore Count On?

Selecting a trustee for your overseas count on includes assessing their experience, online reputation, and understanding of your goals. Seek somebody trustworthy and knowledgeable, and ensure they're acquainted with the regulations governing offshore depends on.

Report this page